What you should Understand

- Individual mortgage brokers offer short-term mortgage loans as an alternative to the major banks.

- Individual mortgage loans possess higher interest levels and you can charges, however, these are typically easier and you will less is acknowledged for.

- Borrowers that may change to the personal lenders are those with crappy borrowing from the bank, people who count on foreign or abnormal money present, and you may beginners in order to Canada instead of a position records.

- If at all possible, personal mortgage loans can be used because the a short-term services as you boost your money.

What are private mortgage brokers?

Personal lenders are private organizations and people you to definitely give out their particular money. Including Mortgage Money Providers, where money from personal investors is actually pooled to fund syndicated mortgage loans. Personal loan providers do not deal with deposits on the public, plus they aren’t federally otherwise provincially regulated.

Personal mortgages are generally shorter and you may include high interest levels and you will costs as opposed to those offered by traditional lenders. He is intended to be a temporary level just before transitioning straight back in order to typical mortgage lenders.

Private Mortgage lenders Across the Canada

Individual mortgage brokers features went on to be an ever more popular choice to have home owners and just have managed an important role during the Canada’s construction industry. Centered on investigation on CMHC, non-bank loan providers originated $ mil worth of mortgage loans inside 2021.

When you’re near to 1 / 2 of which were from borrowing unions, there had been nevertheless 306,000 mortgages originated in 2021 by individual lenders, worth near to $100 million. So it provided mortgage financial institutions (MFCs), financial money organizations (MIEs), and trust organizations. There are many loan providers where you could score a personal financial regarding.

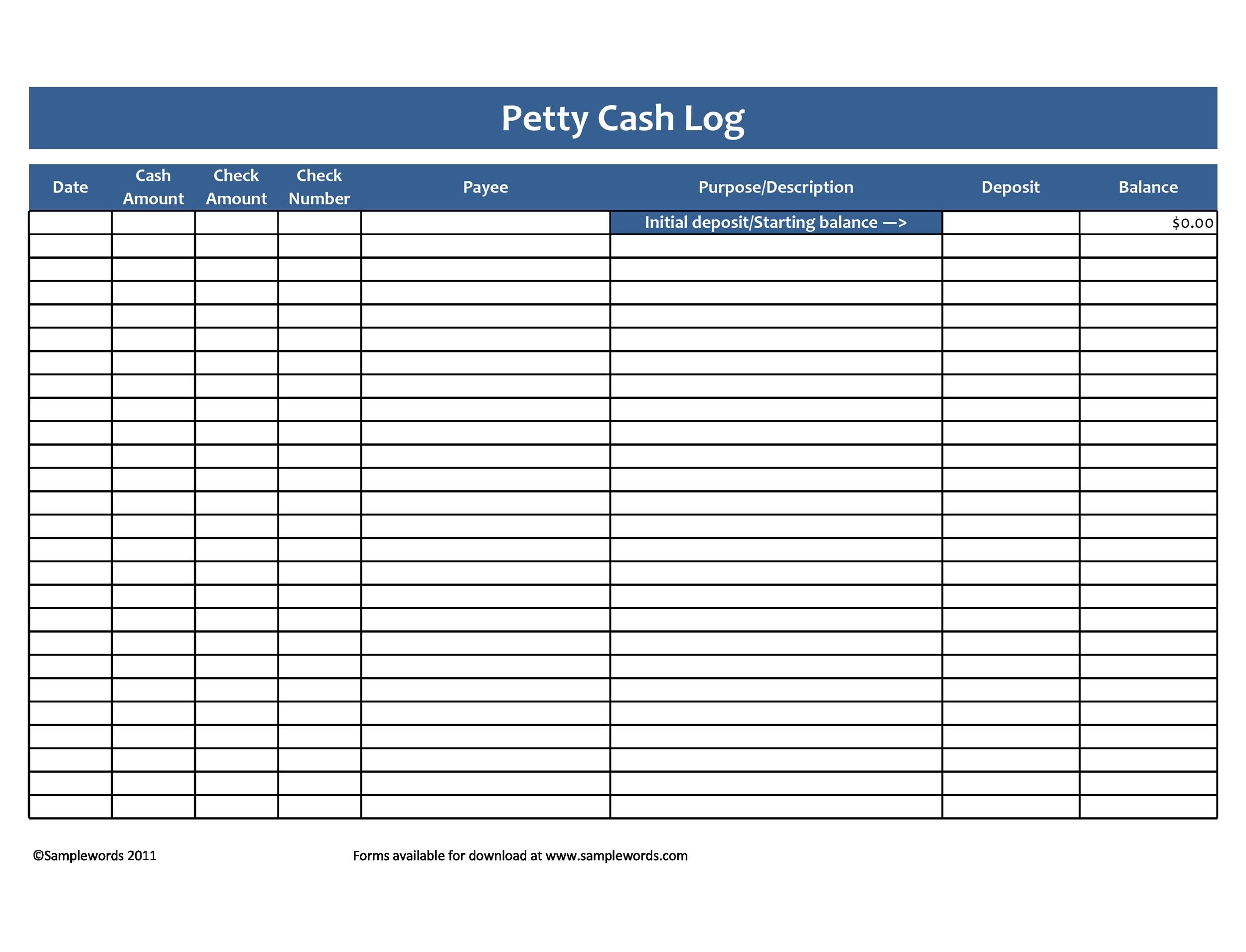

New dining table below directories various private lenders inside Canada and you will compares its individual mortgage prices, restrict LTV ratio https://www.clickcashadvance.com/personal-loans-ri/, once they allow attention-merely payments, incase he has got no lowest credit rating requisite.

When you have a reduced or subprime credit history lower than 600 , you’ll likely you desire a personal bank. Lenders can use your credit rating to look at the financial fitness, that will translate into being qualified having a home loan or not. Perhaps not forgotten any money, which have a decreased credit utilization price, carrying a reduced (or no) equilibrium towards the credit cards, and having an extended credit rating usually improve your credit history.

A minimum credit score of 600 will become necessary getting CMHC financial insurance coverage. Because so many B Lenders deal with insured mortgage loans, not being able to qualify for good CMHC covered home loan will ban you from of numerous B Lenders. Loan providers also can need you to see financial insurance policies even if you make a deposit larger than 20%.

How do i have a look at my credit score?

The 2 credit agencies in Canada are Equifax and you may TransUnion. You can consult your credit score and credit history from these enterprises by the mail otherwise on the internet free of charge. Nonetheless they bring most products getting a charge, for example borrowing from the bank keeping track of.

Equifax and you can TransUnion just declaration guidance in this Canada, even though they work with of a lot nations like the United states. Your credit report outside Canada may not be recognized dependent on debt establishment. Newcomers and the fresh new immigrants so you’re able to Canada might have troubles being qualified to have a home loan if they have a limited Canadian credit score.

Who can individual mortgage brokers let?

Personal mortgage brokers let complete the fresh pit kept from the old-fashioned loan providers. Those with a restricted Canadian credit score, such as for instance the fresh immigrants, can get face a lot more obstacles of trying to locate mortgage recognition out-of banking companies. Home loans also may help people with difficulties delivering recognized having home financing. Other gurus is present on our webpage on home loans against finance companies. At the same time, personal lenders may help the second individuals.