Monthly Mortgage payment

Your own homeloan payment getting good $333k family is $2,220. That is according to good 5% interest and you can a ten% down payment ($33k). This includes estimated possessions taxation, threat insurance policies, and you can home loan insurance fees.

Money Needed for an excellent 300k Mortgage

You ought to make $111,009 a-year to cover the a beneficial 300k home loan. I ft the amount of money you prefer on the an excellent 300k financial to the an installment that is 24% of the monthly money. In your case, your month-to-month earnings will likely be on $nine,251.

You can become more conservative otherwise an effective little more competitive. Possible transform this inside our how much family should i afford calculator.

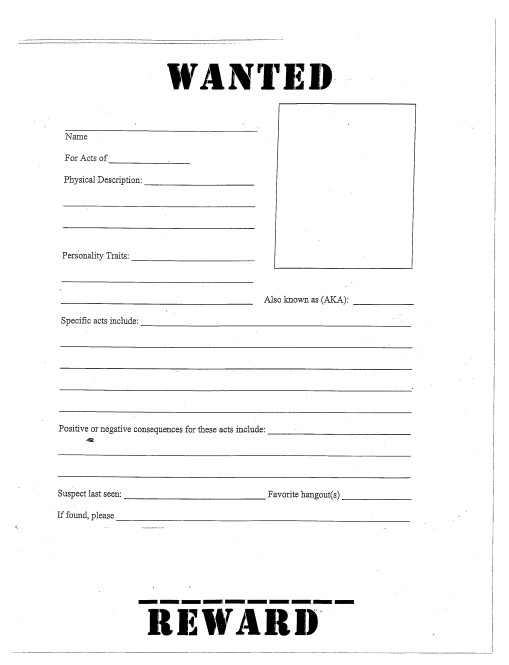

Do the Test

Use this enjoyable quiz to find out simply how much house I are able to afford. It takes only a few momemts and will also be capable feedback a personalized investigations towards the bottom.

We shall make sure you commonly overextending your financial allowance. You will has actually a soft count on the checking account once you get your house.

Cannot Overextend Your allowance

Financial institutions and you will real estate agents make more money when you buy an even more costly home. Oftentimes, banking companies tend to pre-agree your for the most that one can perhaps afford. Right out of the entrance, before you start traveling house, your budget might possibly be lengthened into the maximum.

It is vital to make sure that you try comfortable with the payment per month in addition to sum of money you should have kept within the your finances when you purchase your home.

Evaluate Financial Pricing

Make sure you evaluate financial pricing before you apply to own a good home loan loanparing step 3 lenders can save you thousands of dollars into the the first few several years of their mortgage. You can evaluate home loan cost into Plan

You will see newest financial pricing otherwise observe financial rates now features trended more than recent years towards the Bundle. I screen each and every day mortgage prices, styles, and you will write off things for fifteen seasons and you may 30 year financial facts.

- Your credit score is a crucial part of the home loan process. If you have a premier credit rating, you should have a much better chance of delivering good recognized. Lenders are far more comfortable giving you a mortgage percentage you to definitely try more substantial part of your own month-to-month earnings.

- Homeowners relationship fees (HOA charges) make a difference your house to invest in energy. Should you choose a house that highest association fees, this means you’ll need to choose a lowered charged the place to find so you’re able to reduce the principal and you will attention payment enough to give place towards the HOA dues.

- Your other financial obligation repayments make a difference your residence funds. If you have lower (otherwise no) most other mortgage money you can afford to visit a little large in your mortgage payment. When you have highest monthly payments for other financing eg vehicle money, college loans, otherwise handmade cards, you will need to back down your month-to-month mortgage repayment a little to make sure you feel the finances to blow any expenses.

Not so long ago, your wanted to make a great 20% down-payment to cover property. Now, there are many financial products which enables you to make an effective far faster deposit. Here are the deposit requirements for prominent mortgage facts.

- Antique loans require a beneficial 5% downpayment. Certain very first time homebuyer software succeed step three% down payments. One or two examples try Family Able and you can House You’ll be able to.

- FHA financing want a great 3.5% down payment. To be eligible for an enthusiastic FHA mortgage, the house or property youre purchasing should be your primary household.

- Virtual assistant funds wanted good 0% advance payment. Active and resigned army professionals could be eligible for https://paydayloancolorado.net/cedaredge a good Va loan.

- USDA fund wanted a great 0% down-payment. Speaking of mortgages that exist when you look at the outlying regions of the brand new nation.

Do you know the methods to buying a home?

- Mess around which includes home loan calculators. Strat to get comfortable with all costs associated with to purchase an excellent domestic. Most people are surprised after they observe how much even more property taxation and you may homeowners insurance adds to their percentage monthly.

- Look at the credit history. Of numerous banking companies usually today make suggestions your credit rating 100% free. You can also play with an application like credit karma.