In this post

- USDA Financial

- Exactly what Credit rating becomes necessary to possess an excellent USDA Home loan?

- Just how are Credit scores Depending?

- Extenuating Things

- Great things about Having a healthy and balanced Credit rating

- Prepared Episodes to possess Foreclosures otherwise Bankruptcy

https://cashadvancecompass.com/payday-loans-nc/

USDA Mortgage

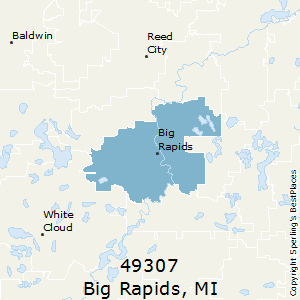

USDA mortgage brokers are perfect alternatives for outlying basic-go out homebuyers. In our prior one or two posts, we covered the primary benefits of a great USDA financial, and also the income restrictions individuals will need to discover. There are certain criteria from the that it mortgage program backed by the us Department off Farming.

We advice you investigate first two content in this show for more information:Area step one: What is a beneficial USDA Mortgage?Region 2: Money Limitations

Exactly what Credit rating will become necessary to have an effective USDA Home loan?

Of a lot earliest-day customers is actually a tiny concerned about their credit rating and you will the way it will effect their capability to help you be eligible for home financing mortgage. Every lenders will look within borrower’s credit history, plus many other secret financial evidence. They might be, but are not restricted to, earnings, debt-to-income (DTI) proportion, a career background, savings or any other debts.

Minimal credit score lay by really USDA-certified lenders will be 640. When you yourself have a beneficial 640 FICO get or maybe more, youre out over a lift whenever trying to get good USDA mortgage. Once more, this isn’t the one thing the lending company and you will USDA have a tendency to view when underwriting and you may approving the mortgage. You could have an excellent credit score, however, enter crappy contour various other parts. Otherwise, you are from inside the great contour because of the rest of your bank account, but have a decreased credit score for whatever reason.

Just how try Fico scores Established?

Essentially, credit ratings are based as a result of payment regarding repeating bills or any other expenses instance rent, insurance, utilities, college university fees otherwise child care. You will find cases where people could have a reduced credit history as they merely have not created far borrowing from the bank. Accumulating a bunch of personal credit card debt will hurt your DTI, nevertheless may actually be beneficial to your credit score if you’re making their minimal monthly payments. Meanwhile, anyone without credit cards, auto loans, rent, college or university university fees or extreme credit rating records may actually have an effective weaker FICO get.

For this reason loan providers and you may loan underwriters will look during the every things to determine if family buyer qualifies getting good real estate loan. For these with a shorter-centered credit rating, the lender can certainly be capable agree this new USDA domestic financing in the place of a non-conventional credit file. There is almost every other 3rd-group verifications which might be utilized to prove you are a beneficial deserving borrowing from the bank candidate.

Extenuating Items

Having USDA funds, not, the very least rating off 640 is a fairly solid benchmark. They do has actually guidance in position that will enable to possess borrowers with straight down scores so you’re able to meet the requirements. Individuals tends to be eligible whether they have knowledgeable a specific extenuating scenario. These include:

- Business layoff due to staff reduction

- Scientific disaster

- Almost every other occurrences outside the applicant’s handle.

The extenuating circumstance have to be a single-big date feel also it really should not be an event that’s almost certainly to occur again. In addition it can’t be a result of the applicant’s inability so you can would their money.

Extenuating facts not in the applicant’s control is the perfect place there was specific gray city since it is a small more challenging in order to establish. When you are not knowing of one’s disease and you will whether or not it may allow you to qualify for good USDA mortgage, it is best to correspond with USDA-authoritative bank.

Benefits of With a wholesome Credit rating

The greater your credit rating, the greater out-of you are when trying to get people financing-specifically good USDA financial. Individuals with credit scores from 680 or even more will benefit out of a streamlined approval processes and then have a much better risk of being qualified. Top scores and you will degree conditions also usually change to lower attract rates for the loan, as well.

Prepared Attacks having Foreclosures otherwise Bankruptcy proceeding

USDA funds are mainly aimed at basic-big date homebuyers. If you have had possessions previously, you might still be able to be considered. You simply usually do not already own otherwise occupy a property and these finance can’t be employed for 2nd belongings or money spent instructions. If you have gone through a bankruptcy otherwise foreclosure, you are subject to a located several months before you could try entitled to a beneficial USDA loan:

To find out if you are entitled to an excellent USDA financing and you may to begin along with your software procedure, get in touch with Moreira Party today!