Imperfections on your borrowing can take place and you will bankruptcy proceeding otherwise foreclosure can be a specific question for those wishing to get property having a USDA mortgage.

The good news is that exist a good USDA domestic loan on wake of those negative borrowing events.

Chapter 7 Personal bankruptcy and you can money loans in Wilton Center Connecticut USDA Funds

Widely known kind of personal bankruptcy, A bankruptcy proceeding is sometimes known as straight bankruptcy proceeding. You’ll liquidate your own assets, which can become property, an additional vehicle, costly choices etc to pay off as much out of the money you owe and you can financial institutions as possible.

But just as this often is the right option for your does not mean that you are out-of fortune to own an effective USDA financial shortly after case of bankruptcy.

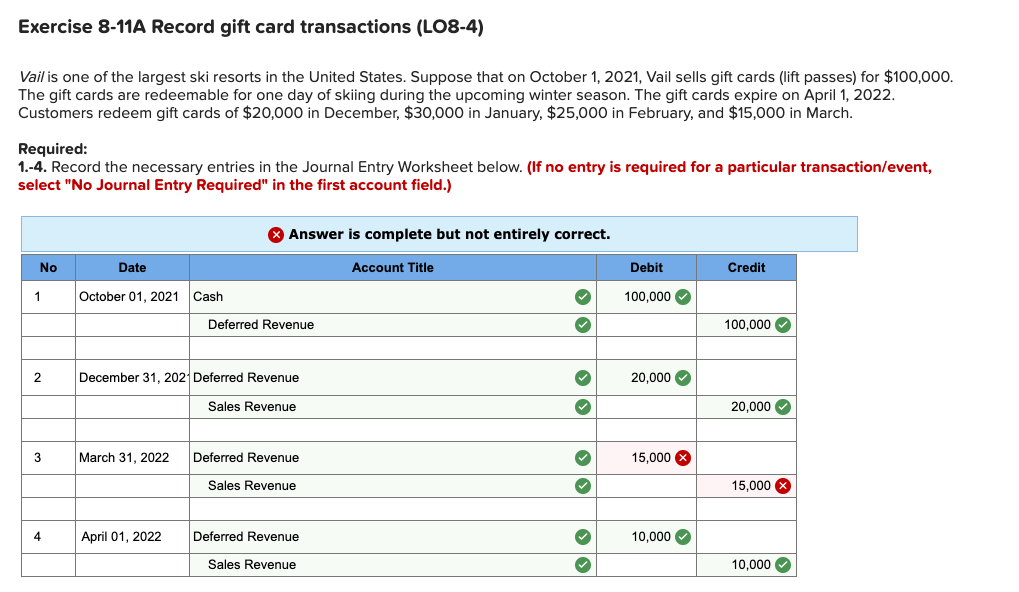

Indeed, in most products, brand new USDA mortgage bankruptcy wishing several months once Chapter 7 bankruptcy is actually only 3 years. Here’s how one to even compares to other preferred loan items:

While doing so, certain items could trigger the USDA Exceptional Factors Difference that allows licensed people to move forward less. The words need applicants so you’re able to reveal new case of bankruptcy was as a result of extenuating things beyond their handle and has once the shown a documented ability to manage the financial activities during the a responsible styles to own a fair time following release.Consumers is likewise able to move ahead till the around three-year draw if they are in a position to receive approval of USDA’s automatic underwriting system.

Simply put, you may want to qualify for a beneficial USDA financing inside the less than 12 months if for example the bankruptcy proceeding is due to anything other than financial mismanagement, specifically things that were short-term in the wild, eg employment losings or illness, having due to the fact been solved.

Specific loan providers could possibly get consider these shorter waiting symptoms, and others will not. Talk with a beneficial USDA loan specialist regarding the particular situation and you can what can become possible.

It is additionally vital to remember that a personal bankruptcy is hurt your own credit history, both significantly. Possible buyers may prefer to spend time trying to increase its borrowing from the bank reputation ahead of getting a USDA financing.

Chapter thirteen Personal bankruptcy and you will USDA Finance

When you yourself have possessions we need to keep, you’ll be able to instead think a chapter 13 bankruptcy. As a result unlike being forced to liquidate your home, youre considering a payment plan that will allow one pay bills over less than six age.

Creditors will minimize getting in touch with, and you are capable behave as common and you will pay your debts, with regards to the decided-abreast of schedule, while keeping your home.

Potential buyers may be able to see good USDA loan simply 12 months taken out of filing a part 13 case of bankruptcy. You can easily generally speaking you prefer an ok from the bankruptcy proceeding trustee in order to take on brand new financial obligation, and you may lenders may take a closer look at the loans fees records since the declaring case of bankruptcy.

USDA Guidance for Foreclosure

If you’ve had troubles spending their mortgage timely toward a beneficial daily basis, it is possible to get a property foreclosure or an action-in-lieu off foreclosure. That means that your own lender requires right back your house following sell in order to redeem at the least some of the money that you borrowed from all of them.

As with bankruptcy proceeding, a foreclosure is also negatively apply at the borrowing from the bank. However it is you are able to in order to still rating an effective USDA mortgage immediately following good foreclosures usually 36 months pursuing the registered time of your own foreclosure.

Home owners who feel a preliminary sales where lender allows you to bring in lower than you are obligated to pay usually normally must hold off 24 months in advance of desire an effective USDA mortgage. Guidance and policies can differ by the bank.

CAIVRS Databases

Residents exactly who feel a foreclosure otherwise short sales into a federal government-supported financial normally deal with additional difficulties. The key would be to ensure that your CAIVRS files are fixed. CAIVRS (that’s pronounced kay-vers and you may means Borrowing from the bank Alert Interactive Verification Reporting Program) is a shared databases out-of defaulted government debtors you to music defaults, delinquencies and you will property foreclosure about federal costs (and not just homes; such as for instance, a student loan you may appear) and certainly will curb your capacity to rating a different USDA financing.

Loan providers will run your data from this databases whenever you are looking for an authorities-supported home loan. Essentially, you’ll need to offer documentation one to any CAIVRS circumstances was in fact fixed if for example the title appears regarding database.

Bankruptcy and you can Property foreclosure a two fold Whammy?

Both a case of bankruptcy and you can property foreclosure go hand in hand. Exactly how which can apply at the USDA financing hinges on and this emerged first.

A citizen which declares Chapter 7 personal bankruptcy and fully discharges their mortgage loans will need to hold off 3 years in advance of being able discover a USDA loan. Essentially, if it house later on goes into foreclosure, the fresh borrower may not be penalized that have a different three-12 months flavoring several months.

Improving your USDA Mortgage Possibility: Borrowing Building Info

A switch mission for getting one financing, and good USDA financial immediately after personal bankruptcy or property foreclosure, was repairing and you may improving your credit score. However, your credit rating does not need to feel prime you are able to qualify for good USDA financing with bad borrowing from the bank.

- Applying for a beneficial secured charge card: These types of notes ask for a refundable security put, upfront; one to gets your own purchasing restriction, hence suppresses you from paying over you really can afford so you’re able to repay and assists your re also-introduce borrowing.

- And also make all of your money timely: It is trick because so many credit reporting agencies pounds this component in the future of the many anyone else. Signing up for on line payments will make sure their look at never gets lost regarding post.

- To avoid too many borrowing from the bank issues: Limit the quantity of moments you may have some body pull the borrowing. Which means perhaps not succumbing to help you attraction to open up a number of this new lines of credit.

- Remain balance under control: An effective principle will be to maintain your personal and you will cumulative mastercard stability at the otherwise less than 30 % of your own credit limit.

Thankfully you to a rocky financial earlier in the day does not always mean you can not get a USDA home loan immediately following bankruptcy or property foreclosure. Rather, you could in the future be on the road on the homeownership once more.