You can buy a mortgage through tips that include: Examining your credit and you can cash, protecting getting a deposit, going for a mortgage lender, getting preapproved, submission an application, waiting around for underwriting and you will get yourself ready for closing.

When you’re like most property owners, to shop for a house with dollars isn’t really an option. Considering current You.S. Census Agency study, 61.5% away from people features home financing on their property.

A mortgage makes homeownership more obtainable, however it is necessary to see the procedure. This is why we’ve got authored it best guide to split it down step by step.

step 1. Look at the Borrowing and you will Cash

Checking your own credit to see where they really stands and exactly how it stands up against typical bank qualification standards is https://paydayloancolorado.net/ridgway/ a great put to start. Your borrowing are a major idea lenders opinion whenever determining the financial qualification and you may rate of interest, thus you need to score a duplicate of your credit file and you can score to see where their borrowing currently stands. With a decent credit rating, you can even be eligible for a great rate and you will term.

While doing so, when your borrowing is on the reduced top, you’ll be able to require some steps to switch the borrowing from the bank get before applying to possess home financing. When evaluating the reports, be looking to have prospective conditions that was hauling off their rating, and remember, there is the to disagreement information on your own account in the event the you would imagine that it is wrong.

Paying your revolving personal debt could also replace your rating rapidly by the lowering your credit use rates, and therefore accounts for 30% of your own FICO Score ? , the new rating design utilized by 90% of the market leading lenders.

Just what Lenders Imagine

Examining debt character makes it possible to assess whether you are almost certainly to-be approved to possess an alternative home loan. Below are a few of the biggest circumstances lenders envision:

- Credit history: The minimum credit history you will need to be eligible for a mortgage ple, you may also be eligible for a normal financing which have a get of 620 or above, but you may still be eligible for an authorities-recognized financing with a reduced score.

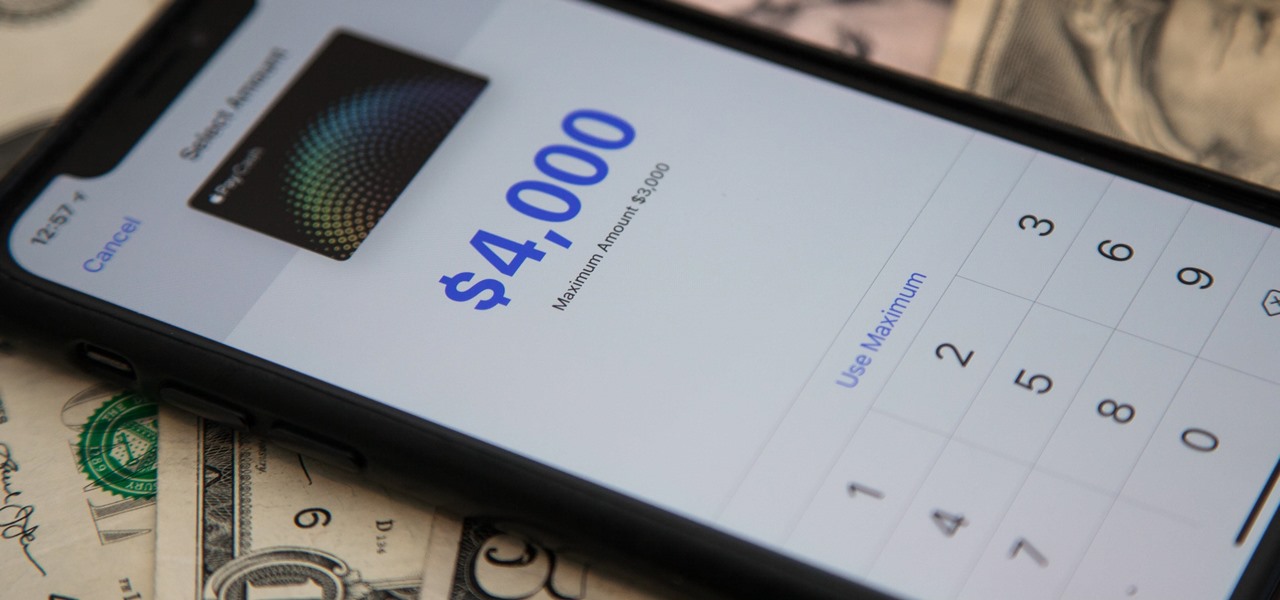

- Income and you will employment: Lenders want to see you have steady and you may predictable income sufficient adequate to support the monthly installments towards the a different sort of home loan. Be prepared to back-up one income and you can employment guidance your enter in your financial application which have records such as for instance W-2s, taxation statements and you can bank statements.

- DTI proportion: The debt-to-income proportion (DTI) ‘s the number of terrible monthly earnings one visits your obligations costs monthly. Loan providers utilize this ratio to choose your financial energy. A lower personal debt ratio may indicate your perform obligations better, when you are a higher ratio could well be a red-flag which you you’ll have trouble with additional obligations. Mortgage brokers normally need the DTI to get below fifty%, many lenders set the newest maximum in the 43% or even as low as 36%.

- Home loan supplies: Loan providers is generally prone to approve the financial for individuals who features enough property such cash in a deposit, advancing years or investment membership you can quickly promote. Particular lenders need such financial reserves if the credit history or DTI does not fulfill the criteria. These assets may assuring lenders which you have quick access to dollars for many who come upon a pecuniary hardship.

- LTV ratio: The borrowed funds-to-really worth (LTV) proportion measures the loan matter as compared to home’s value. Lenders essentially like to see LTV percentages less than 80%.

2. Help save for a down payment

An alternate basis mortgage lenders thought is the number of the down percentage. Since your deposit reduces their LTV ratio, a larger it’s possible to alter your recognition possibility and you will financial speed. A good 20% down-payment is a type of goal for consumers having antique money given that an expense less than that draw mode you will need to spend getting personal mortgage insurance (PMI).