Once the detailed a lot more than, applications having round three earliest-mark PPP finance from acknowledged society creditors become on the . Second-draw apps began on the . That was with very first- and you can second-mark money of small lenders with less than $step one million within the assets toward . All SBA 7(a) loan providers had been approved to simply accept first- and you will 2nd-mark programs creating toward .

Third-Round PPP Software Due date

Brand new Consolidated Appropriations Act, 2021 prolonged the new Salary Security System due to , or until loans ran out. Congress expanded new Salary Defense Program’s application due date as a consequence of . So far the new PPP are no more available.

The degree of money provided about third bullet totaled $284 mil. Maximum financing away from $10 mil was indeed open to very first-mark consumers, and you may loans around $2 billion had been open to second-mark, small business owners.

App Procedure getting a 3rd-Round PPP Financing

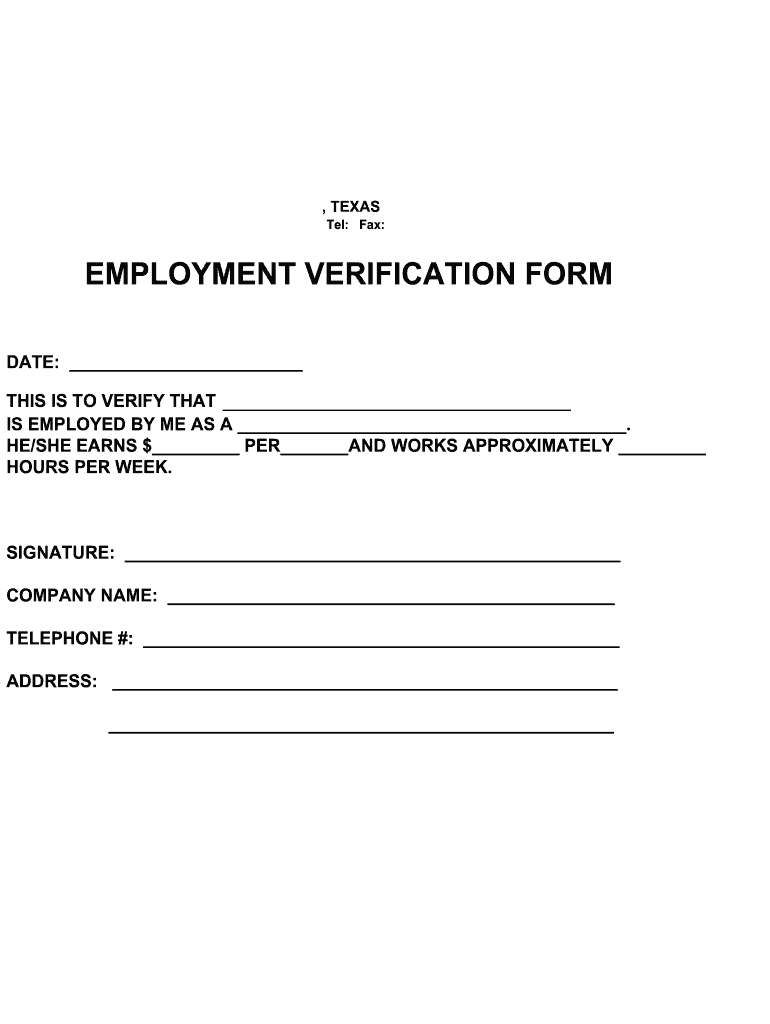

Brand new earliest- and you may second-mark money used a period the same as you to followed having past PPP financing. Entrepreneurs you will download and you may complete the mortgage software away from the newest SBA web site.

Covered Period to possess Third-Bullet PPP

Bullet one to and you may bullet a couple PPP finance specified that months during which a corporate needed to have fun with its mortgage proceeds (the fresh safeguarded period) is seven weeks, beginning with the big date in the event the organization gotten its loan continues. Which was afterwards offered so you’re able to 24 months.

Round three desired a corporate to decide both eight months or 24 weeks, providing it more power over how to deal with one called for decreases within the team, immediately after PPP loans were exhausted.

The latest part of one another first- and you may second-draw PPP fund that had for usage to possess payroll expenses so you’re able to qualify for financing forgiveness.

The means to access 3rd-Round PPP Financing

New CAA stretched the kinds of expenses for which a business can use bullet three PPP funds. In addition, it put on current PPP financing funds (until the organization already got acquired forgiveness).

And payroll, rent, protected financial attract, and you can utilities, the fresh Paycheck Coverage System greet a corporate to make use of mortgage proceeds for:

- Specific operations expenses together with organization application; business-related affect calculating characteristics; products delivery; payroll processing, percentage, and you will tracking costs; recruiting (HR) and you can charging you attributes; record regarding supplies, directory, suggestions, and you can costs

- Secure assets destroy will cost you along with will set you back pertaining to damage or vandalism due to looting or public disruptions for the 2020 that were not covered by insurance coverage or other settlement

- Indexed provider will cost you and additionally money so you can a merchant of goods you to definitely was indeed necessary to functions making pursuant to an agreement or acquisition ultimately when before secured period or, when it comes to perishable products, in place when in the safeguarded several months

- Shielded employee safeguards expenditures along with operating or investment expenses necessary to follow requirements or information given by U.S. Locations for Disease Manage and you will Cures (CDC), Agencies out of Health insurance and People Qualities (HHS), Work-related Safe practices Government (OSHA), or people county or local government when you look at the months delivery , and ending towards the date if the national emergency ended

Taxation Treatment of Third-Round PPP Financing

Round around three PPP financing weren’t used in an effective company’s taxable money. In the event the financing was forgiven, expenses paid down with the proceeds of your mortgage payday loans for Colorado was in fact tax-deductible. Further, it rule applied to the newest, current, and earlier in the day PPP financing. Simultaneously, any tax foundation increase one to resulted of a great PPP mortgage remained even if the PPP mortgage is actually eventually forgiven.

One PPP fund that have been wrongfully forgiven often due to omission or misrepresentation from the taxpayer could well be managed given that nonexempt earnings, once the Internal revenue service (IRS) established during the . New Internal revenue service is guaranteeing you to definitely just who which guidance pertains to file, if required, an amended come back.