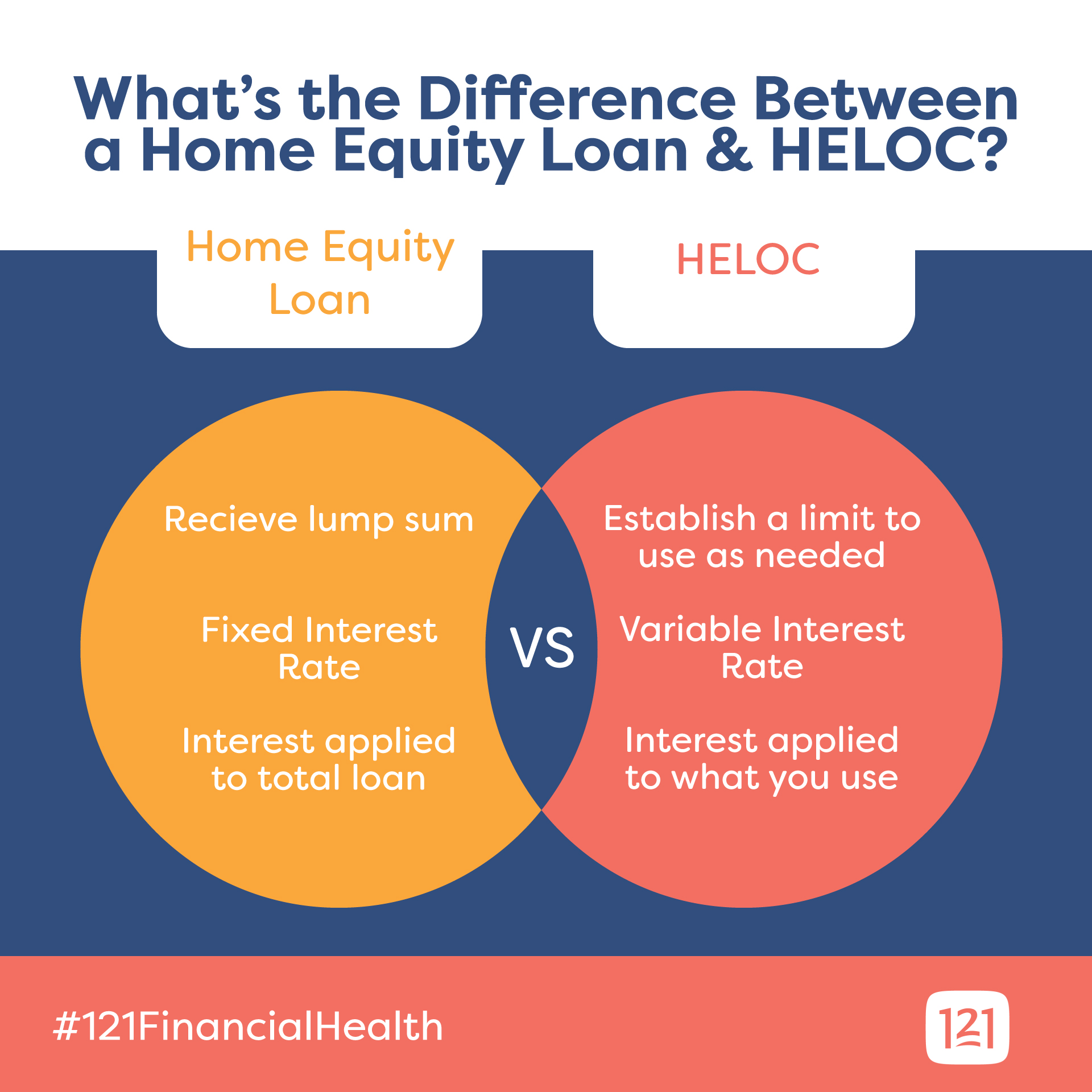

- In collateral finance, you should make your house because the guarantee along with in order to acquire your finances up against the guarantee. There is a risk of foreclosures after you create your house while the collateral. HELOC(Family Guarantee Line of credit) and you may Domestic Security Financing. Collateral money take a longer period to track down acknowledged, when you yourself have unexpected repairs, it financing will never be a suitable option for you.

- What about Into the-house financing and money-aside refinancing? This type of mortgage alternatives has actually highest home loan rates and you will rates of interest. Domestic Security Credit line as well as made use of as the 2nd mortgage loans keeps highest settlement costs. So it loan option is also applied for up against your residence. Cash-aside refinances want highest home loan repayments that can hurt you wallet. And the first mortgage, residents must also pay the second home loan in this capital option.

- You can’t financing crisis fixes and enormous home improvements while financial support their home improvements having a credit card. Bank card money is suitable for a little home renovation venture.

- The fresh new Federal Casing Administration(FHA financing)want high interest rates. If you are planning in order to redesign your property having FHA loans, the increased https://paydayloansconnecticut.com/moodus/ family worth was less than extent your has actually borrowed and you can paid off since rates of interest. You additionally have property standards from inside the FHA financing.

There is absolutely no highest origination fee home based improvement finance. After you use do it yourself funds for home improvements and you can fixes their origination payment cannot vary. You may get the true rate and also the mortgage name your is qualified for.

Could you be fretting about early repayments? There are no prepayment punishment within the personalized home improvement fund eg most other collateral fund and money-out refinancing choices. It’s possible to finance all the renovations within good repaired rate for those who acquire the loan number from TGUC.

For everyone high home improvements, a house improvement financing is the greatest option. High renovations eg Bathroom and you may cooking area renovations functions increases brand new property value your property exponentially. Towards do it yourself loans, you will be able so you can renovate the kitchen and you may bathroom spaces without having to pay even more charge.

You do not have a beneficial credit rating having renovations. People are usually expected to possess excellent credit scores if you find yourself borrowing collateral loans. If you’re planning to help you renovate your home having do-it-yourself funds, it’s not necessary to have confidence in your credit scores.

And come up with your home since equity is not a necessity inside TGUC Monetary, therefore no huge risks if you are credit the borrowed funds . A home update financing cannot make your home collateral. Thus, there is no risk of foreclosures! You don’t need to shell out highest settlement costs. Most other family restoration money for the Fl tend to request you to explore your residence because the security. However, TGUC economic even offers actual-big date interest levels and you may loan amounts without having any equity percentage.

Get a loan both for lesser and you will big renovations. TGUC home improvement mortgage gives you a loan getting most of the restoration performs. We shall give you money to have disaster repairs, high renovations, and you can small renovations.

Guarantee and you will Mortgages that want household while the security with quite a few constraints

Home owners won’t need to care about fluctuating interest levels and you can month-to-month costs. We’ll provide you with that loan getting fixed interest rates.

Exactly how TGUC Monetary will allow you to?

- You can acquire property update financing despite a decreased credit rating.

- We shall simply be sure your income info. The loan gets recognized quickly immediately after verification.

- No security fee therefore we try not to help your house be while the guarantee.