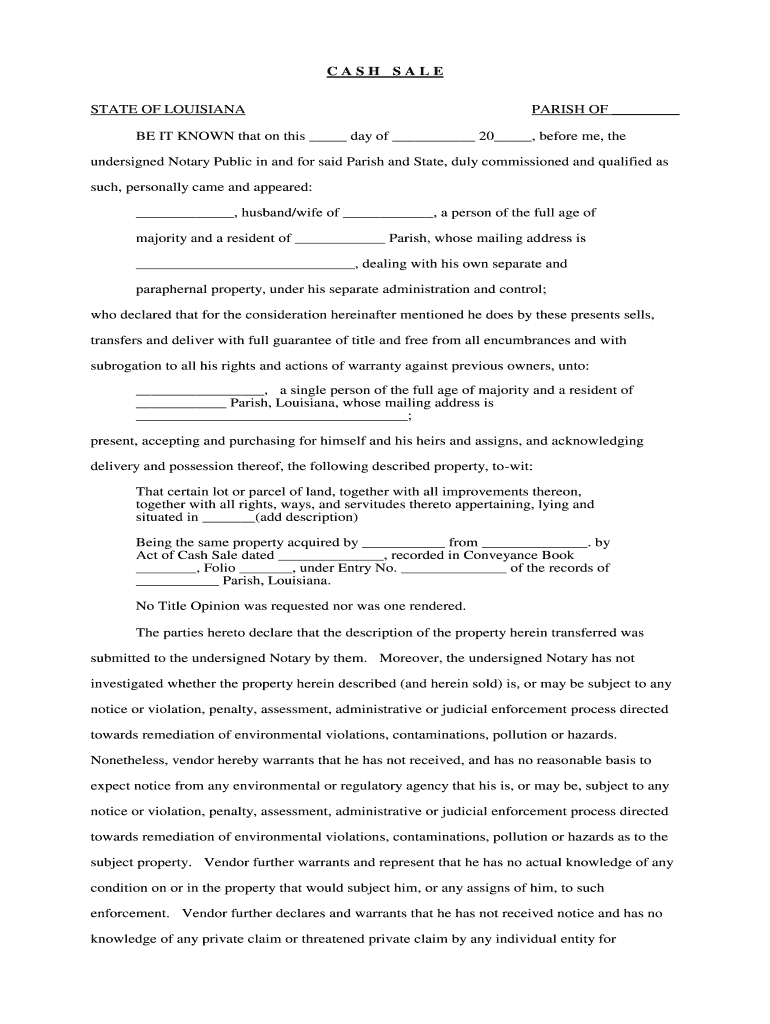

Throughout the 350 members of the Relationship off Community Organizations having Change Today assemble to possess a rally prior to the U.S. Capitol , to increase attention to domestic foreclosures drama and prompt Congress to let LMI household remain in their homes. (Images of the Processor Somodevilla/Getty Photos)

Initially, the new expansion from Federal Set-aside credit is financed by eliminating the fresh new Government Reserve’s holdings regarding Treasury ties, in order to prevent a rise in bank supplies who does push the fresh government finance price less than the target due to the fact banking institutions sought for to help you provide away their continuously reserves. In , new Federal Set aside attained the ability to pay banking companies desire with the their excessively reserves. Which offered banks an incentive to hold to its supplies alternatively than financing all of them aside, ergo mitigating the necessity for the latest Federal Reserve so you can counterbalance their extended lending with reductions in other property. dos

Effects on the Greater Economy

The latest housing industry added not just the newest financial crisis, but also the downturn into the broader economic hobby. Domestic money peaked inside the 2006, as did work when you look at the residential build. The entire discount peaked when you look at the , the latest week this new Federal Agency away from Monetary Lookup understands given that beginning of the credit crunch. This new reduction in overall financial hobby try small initially, but it steepened greatly from the fall out-of 2008 since worries in the monetary places reached the climax. From level to trough, All of us gross home-based tool dropped because of the 4.step 3 %, making this brand new strongest credit crunch as The second world war. It had been also the longest, long-term 1 . 5 years. This new jobless price increased significantly, away from below 5 per cent to help you 10 %.

Responding to help you deterioration fiscal conditions, the newest FOMC reduced their address on the government funds speed out-of cuatro.5 per cent at the conclusion of 2007 to help you 2 per cent at the the start of . As overall economy therefore the financial contraction intensified regarding fall of 2008, the new FOMC expidited the interest cuts, using speed to help you their productive floor a goal variety of 0 so you can twenty-five basis issues towards the end of the season. When you look at the , the fresh new Government Put aside and additionally initiated the original in the some large-level asset pick (LSAP) programs, to order home loan-supported ties and extended-identity Treasury ties. This type of purchases was indeed designed to set downwards tension towards a lot of time-name interest rates and you may raise financial criteria far more broadly, and thus support financial activity (Bernanke 2012).

The fresh market meltdown concluded into the , but economic fatigue continued. Economic gains was only modest averaging from the dos per cent in the 1st several years of your recuperation and the jobless rates, particularly the rate from long-identity unemployment, stayed in the typically increased membership. Facing so it longer tiredness, the newest Federal Put aside managed an especially low level to your federal funds price target and you can desired new a way to bring more monetary rental. Such incorporated a lot more LSAP software, understood way more popularly since the quantitative easing, or QE. The newest FOMC plus first started interacting its objectives getting coming policy settings even more explicitly in social comments, especially the affairs below and this extremely low interest rates had been almost certainly is compatible. Such as for instance, during the , this new committee reported that it expects that very low interest rates would will always be appropriate no less than provided new unemployment speed was above a threshold property value six.5 % and you can inflation are likely to be just about a half payment part above the committee’s dos % lengthened-focus on goal. This plan, called send advice, are meant to persuade individuals that prices create stay lower about until certain economic climates was basically satisfied, and thus putting downward stress toward expanded-name rates of interest.

Consequences with the Financial Control

In the event the monetary business disorder got subsided, interest without a doubt looked to reforms on monetary business and its own oversight and you may regulation, motivated by the a need to stop similar situations down the road. A lot of procedures was basically advised or set up to attenuate the possibility of financial stress. Having old-fashioned banks, you can find high expands regarding the quantity of requisite capital full, which have big develops for so-titled systemically very important institutions (Lender to possess All over the world Agreements 2011a; 2011b). Regular be concerned comparison will assist both financial institutions and you will government see risks and certainly will force banking institutions to utilize money to create financing alternatively away from expenses returns since the standards weaken (Board away from https://clickcashadvance.com/loans/open-bank-account-online-no-deposit/ Governors 2011).