While it is crucial that you get an effective pre-acceptance ahead of time looking a home, it pleads an excellent question: Just how long was a mortgage pre-approval ideal for? It’s important to consider that it as checking out the process of finding a house (last but most certainly not least purchasing you to definitely) might take from around a few weeks for some months.

Depending on and therefore financial you decide on in addition to their recommendations, its typically anywhere between 60-ninety days. Much time facts brief living away from an effective pre-acceptance can vary. No matter if here at Path, our pre-approvals are great for all in all, ninety days.

You can, although not, ask for an extension about much time it is valid getting. To do very, try to have the ability to provide status with the files on the the termination of one initially termination. Underwriters will demand this to ensure everything is still in order. This will essentially be studied care of on the same big date you supply the documents when you look at the.

Pre-Certification vs Pre-Approval

Firstly, we should make sure to appreciate this: An effective pre-recognition isn’t the identical to good pre-degree. A beneficial pre-degree is an individual’s “top guess” in the that which you you’ll be eligible for, but really only according to an easy report on your details. A pre-acceptance, but not, has been through an enthusiastic underwriter (the genuine decision-founder on the an endorsement). They’re giving you a determination on your own mortgage-worthiness that is centered on products. An excellent pre-recognition will actually bring more excess weight which have a supplier.

The place to start this new pre-approval procedure

If you are thinking, the practical takes you to definitely 3 days to online payday loans Ohio help you issue an excellent financial pre-acceptance letter. Yet not, within Movement, its the objective to include you a completely underwritten pre-approval contained in this half a dozen days of receiving their complete app*, in the event the licensed. To get been to the processes, everything you need to manage is actually apply at your local mortgage administrator. They’re going to assist you about what you need to bring. If you’d like a substantial, regional mortgage administrator in order to connect with and also have become, view here and locate that near you.

The way i is always to day my personal pre-approval

We now have figured home financing pre-acceptance is good for approximately ninety days (provide or take). Knowing that it, it is best to initiate new pre-acceptance processes while confident on the buying a property. If the credit might use certain improving, make certain you might be functioning to your borrowing from the bank resolve. Consider expenses which might be weighing their score down.

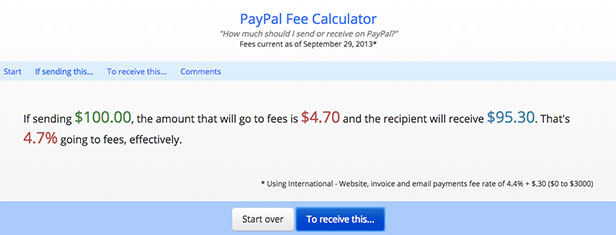

You can always at the least start by an initial discussion having a loan manager too. Capable area you on the right advice out-of what you have to do before going ahead and submission the application. Please additionally use our very own free home loan calculator in check to save you time initial but if you want an easy glimpse on a possible estimate. But not, for the brand new clearest image of what you can afford, it could be far better contact that loan officer towards you when you’re ready to help you proceed.

Precisely what do I wanted to have a good pre-recognition?

There was a good level of documentation which is usually required in order to get an excellent pre-recognition given. You may need things such as for example:

- Spend stubs

- W2s

- Financial statements

- Confirmation of a position

- Photo ID

- And perhaps far more

The good news is, Course did towards making this processes simpler for you. You need to use our very own EasyApp with these financing officers under control so you can sync and you may digitally upload most of these files. Thanks to a simple talk that have financing administrator, you might determine what form of mortgage commonly suit your state greatest, and you will what additional documents would be expected after that.

To order a house is a significant step. It needs weighing out larger behavior to make sure you really have particular items in purchase. When looking instance a demanding processes, it will not need to be once the hard or stressful as it can get initially see. And you can we’re right here so you’re able to in the act.

When you have anymore inquiries or are ready to score the pre-recognition decision, get hold of your local financing manager today.

*While it is Way Mortgage’s objective to add underwriting efficiency within this six days of getting a loan application, process fund during the one week and close-in 1 day, extenuating circumstances could potentially cause delays outside that it screen.

The market Enhance was a weekly statements written by a group of motion Home loan financing segments experts with many years away from combined possibilities on the monetary field. Movement’s group support simply take difficult monetary subjects and start to become them to the a helpful, easy to see analysis so you can improve better conclusion for the economic future.