Content

- What is the Go back to Player (RTP) rates from Baby Bloomers?: bitcoin casino Bustabit no deposit bonus

- High Money Transfer: How Boomers Is Passing to the Fortunes to their Heirs

- How try Seniors Talking about Their health?

- Ramit Sethi: 16 Couch potato Income Side Performances And make More money within the 2024

- How to Enjoy

It’s just sheer one Gen X as a whole manage very own much more wealth than Gen Z. Just before we look on the cause of the present day generational riches gap, it ought to be explained one to particular difference between wide range height ranging from a few years is typical and be anticipated. “Which is harder for folks who have bodily operate minimizing employment knowledge, but we feel many people bitcoin casino Bustabit no deposit bonus could work longer than they are doing today,” Eschtruth said. To build as often — or maybe more — money since the boomers, young generations will have to make the most of compounding interest. Still, along side second decade it intergenerational transfer can make millennials “the brand new richest generation ever,” depending on the annual Wealth Declaration because of the around the world a property consultancy Knight Frank. Yet not, 55% of seniors whom decide to leave behind an enthusiastic inheritance told you they are going to bequeath below $250,100, Alliant found.

What is the Go back to Player (RTP) rates from Baby Bloomers?: bitcoin casino Bustabit no deposit bonus

Complete, Child Bloomers is great for professionals who appreciate charming layouts and you may easy game play, nonetheless it might not fit those individuals looking for huge earnings or a lot more vibrant features. Of a lot Middle-agers are at a period with their family where he could be thinking about mobile money to a higher age bracket. That which you very own comes with very first topic items in addition to such things as characteristics, money otherwise later years profile, holds and you can securities, ways, jewelry, stamp or coin collections, etcetera., Mazzarella told you. Professionals define how boomers can be determine in which it fall anywhere between poor, middle-class, top middle-income group and you will steeped.

High Money Transfer: How Boomers Is Passing to the Fortunes to their Heirs

- Becoming a good notary finalizing representative, you need to first end up being a good notary.

- “Cellular banking application make it so easy to monitor where you are having your money,” says Sonali Divilek, head out of digital avenues and you can some thing in the Pursue.

- Not merely will they be the best-producing something through the winter season and you may past, but with the proper framework, they can servers and be typically the most popular clothes portion for your audience.

- Millennials should be thinking about installing a home package.

Current records tell you an increasing unplug anywhere between how much next generation wants for on the “higher wide range transfer” and just how much their aging parents plan on making them. For these currently retired, Societal Security indeed helps enhance the money, but the average work for is merely $step 1,691.53 30 days. Therefore, of many resigned boomers might need to tighten their spending a good portion to make sure they are able to keep life conveniently while in the senior years. Kiyosaki, an excellent staunch a house individual just who notoriously has 15,000 functions, is urging Boomers to sell their houses. “If i were a young child away from a BOOMER … I might push my mothers to sell their property, brings and securities now … when you’re costs are highest … before the Freeze which is upcoming,” the guy composed within his current article.

How try Seniors Talking about Their health?

- However the societal will not learn the brand new magnitude of the situation, said Jack L. VanDerhei, search manager during the Employee Work for Search Institute.

- The new large-paying symbols are created while the a bunny, a tiny sheep, and a great duck.

- Management professionals consult businesses to change different factors of an excellent company, along with productivity, management and you can image.

- Luckily, you will find lots from cashback looking software you could potentially apply of.

- Among infant boomer houses having later years discounts, the fresh Transamerica Cardiovascular system to have Old age Training estimates its average well worth from the $289,000.

Introducing the brand new intimate field of Child Bloomers by Booming Video game, where lovable farmyard pet spring alive within the an exciting burst of color and you can enjoyable. It on the internet position video game grabs hearts with its lively graphics and you can a country beat one instantaneously set a good lighthearted disposition. Profit and you can do just fine on the best of Kiplinger’s suggestions about spending, taxes, senior years, individual financing and more. Performing a lasting wide range government plan feels like doing a tunes playlist — it’s extremely personal and certainly will include a variety of layouts. In certain parts, somebody disregard to incorporate in their assets things such as old pensions, dated 401(k)s out of earlier operate, genetics, Dvds, annuities and leasing money from money functions.

Ramit Sethi: 16 Couch potato Income Side Performances And make More money within the 2024

Financially speaking, millennials have not had most of a rest plus the closure of the riches gap is then delay. “Possibly the simply good news I shall features in this entire conversation,” VanDerhei told you, is the fact a great 2006 congressional act gave employers expert to help you instantly register team inside the 401(k)s. You to definitely gets more people to keep, nonetheless it generally professionals more youthful professionals that have many years to accumulate bucks and you can progress. The newest Federal Institute to the Later years Protection (NIRS) calculates you to a couple of-thirds away from homes decades has savings equal to lower than the annual money. “Easily must retire I’d getting bankrupt pretty soon. I’m able to probably endure 6 months so you can a-year.”

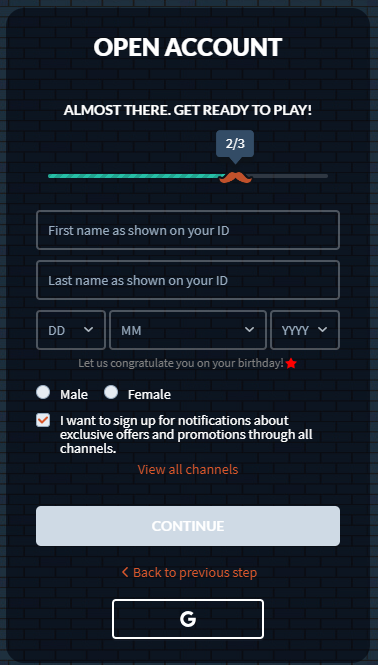

How to Enjoy

“If you’ve got a precise-benefit bundle that is guaranteeing your $50,100 a year, you will be delivering one inside the monthly installments to the rest of your lifetime,” VanDerhei said. “A great 401(k) bundle provides you with a lump sum from the 65, as there are absolutely nothing stopping you against blowing through that very easily.” “They have not seen its old neighbors not having enough currency yet ,,” VanDerhei told you. “It will take years’ worth of stories to your nights information, proving the brand new predicament of those retired people not having enough money.” To that particular point, 68%, out of millennials and you will Gen Zers have obtained otherwise expect you’ll found a keen genetics from nearly $320,000, on average, Usa Now Plan discover. As well, 52% out of millennials believe it’ll score much more — at the very least $350,100000 — based on an alternative survey by the Alliant Borrowing Union.

To be on song for the address, Fidelity says somebody have to have booked five times the paycheck by ages 55. Which have such a large disparity inside wealth, you may think unlikely one to most other generations is ever going to catch up to help you Boomers. But something you should bear in mind is the fact that more youthful generations feel the power of time and you may compounding attention on their front side. Meanwhile, viewpoints out of passed on riches is changing, according to BlackRock’s Koehler. Moms and dads want to become certain that the new generation is certian to get the same well worth system as much as building wide range. The main difference is really because “moms and dads are only maybe not interacting well with their adult people regarding the financial topics,” told you Isabel Barrow, manager of monetary planning at the Edelman Financial Motors.