An illustration

Client A have an effective 4% price, when you’re Buyer B features good cuatro.25% speed. Both are to purchase good $250,000 family. Buyer A will pay $179,674 in the appeal if you are Visitors B will pay $192,746. This is certainly an improvement from $13,072. Then you must incorporate which interest with the additional desire Visitors B is spending money on this new closing costs about financing. Investment new settlement costs causes it to be more complicated to qualify for financing and large interest rates often means a bigger payment per month, which will force your allowance. Should your borrower certification happen to be rigorous then the high attention rates could well be problems.

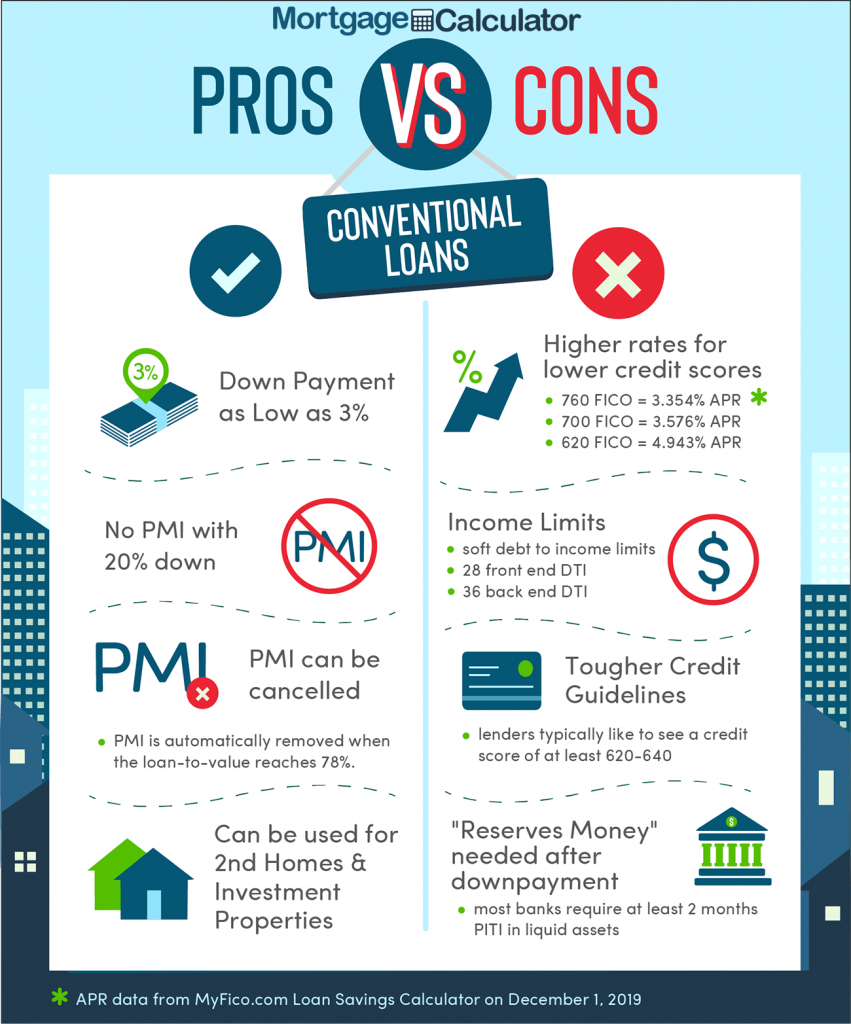

Personal debt to Income Proportion

Your debt-to-earnings ratio is the part of your income that is going on purchasing the debt every month. Many lenders like to see a good amount of 43% or quicker. This profile ought to include what you are shelling out for their financial, also college loans, playing cards, and every other costs you have. If you are acknowledging a high rate to fund this new closing costs next this can improve your payment per month. When you are boosting your monthly payment, you have a high debt responsibility.

Even though you is okay toward a lot more notice and generally are providing a zero closing prices financial, it doesn’t mean you don’t have currency due in the the fresh new dining table. Your lender can get will let you possess that loan which takes care of typical closing fees, such as for instance taxation recording otherwise escrow. not, you may still need to pay to possess anything typically recharged as the settlement costs, such as for instance private mortgage insurance rates, transfer costs, or home taxation.

If you’re considering a no closure pricing mortgage then you definitely is to contemplate the option very carefully. You need to weighing advantages and you will drawbacks and keep maintaining some things in your mind. What is your own determination for finding the fresh zero closing costs loan? Exactly how much could you be rescuing from the failing to pay any settlement costs initial? What is the the latest financing rates and just how far does it apply to your own monthly installments? How much time are you willing to want to stay in the house?

The option for the though a no closure rates mortgage is right for you is about to depend on the length of time you intend on residing in your house. If you are planning to stay in our home towards complete mortgage term then you’ll definitely end purchasing a great deal more getting the new closing costs, in the long run, because of the interest rate. Yet not, if you intend into the swinging inside a few years of shopping for then the financial effect of the large rate of interest might not count as much. When you have small-identity agreements to the capital after that failing to pay closing costs may end up being an effective strategy. But not, if you were to think associated with family as your permanently household, it’s probably better to pay settlement costs upfront, rather than in the longevity of https://paydayloancolorado.net/mountain-village/ the mortgage.

You need to use different financial calculators to determine in the event the a no closure cost home loan suits you but there are even other facts to consider.

Many people are only entitled to a loan if they commit to provides a certain amount for a deposit. This is the bulk of coupons for many individuals and you may around isn’t enough to pay for settlement costs. As opposed to needing to drop to the a crisis money or coupons, a no closing prices financial will be the only way that you could potentially undergo towards the buy. If this sounds like the truth, you have to determine whether the cost of these types of mortgage is right for you or you is cut a great deal more before buying a home.