- Available in outlying and you can cities, offering reasonable-interest rates and you can favorable conditions.

- No down-payment, and you may closing costs might be rolled into mortgage.

- Minimal credit rating away from 640, possessions have to be inside the a beneficial USDA-qualified town, and you will evidence of constant employment.

- Early in the day people can meet the requirements, and you will refinancing is just to own present USDA-guaranteed funds.

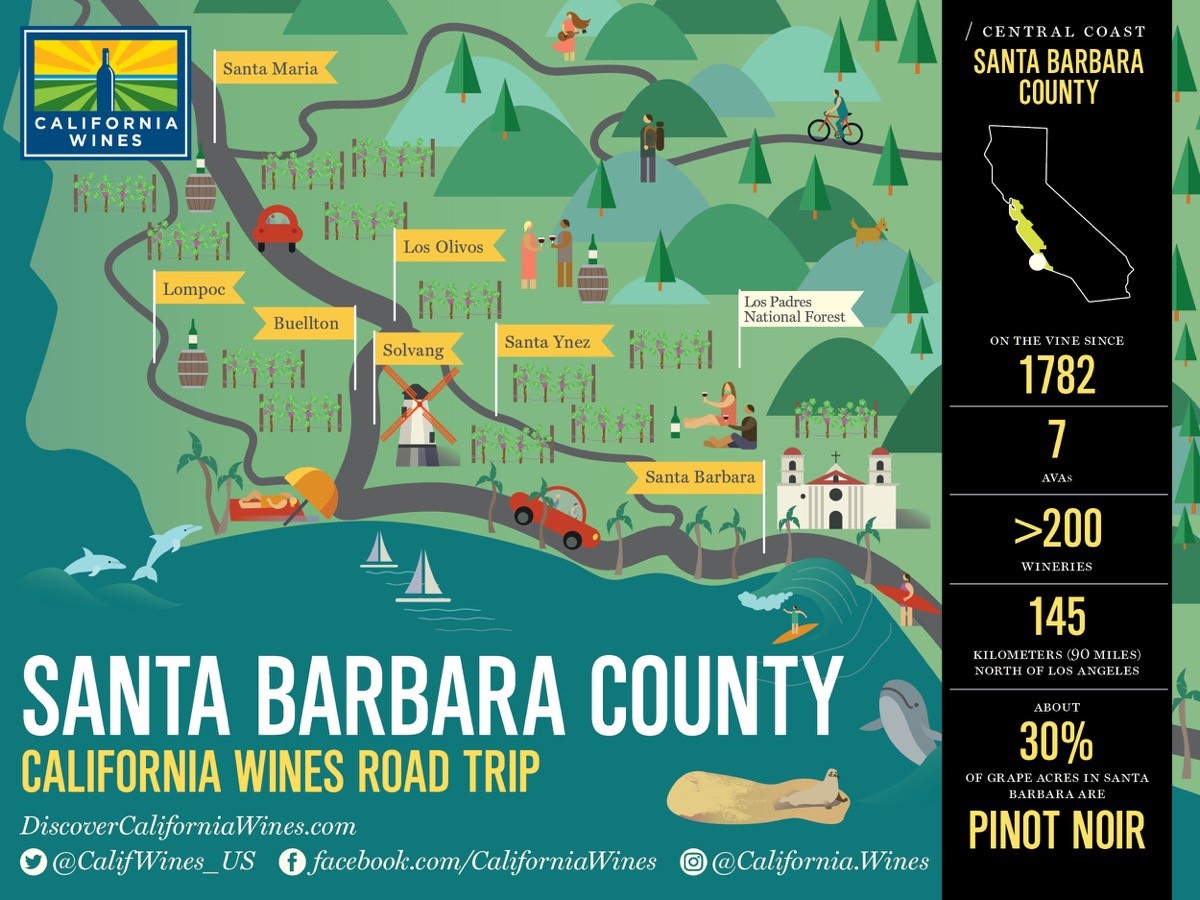

Miami, Orlando, Tampa, and you may Hand Beach, Florida might catch mans appeal however, are you aware that Jefferson Condition, Florida is actually 100% outlying as it is Lafayette State? On these areas, you can buy a USDA mortgage to invest in a house that have advantageous conditions and reasonable-rates. Over 80% of your County out-of Fl qualifies given that a rural area, so you can obtain a home on these towns and cities having USDA investment, whether you’re an initial-date family visitors or not.

What are USDA Loans?

USDA fund is backed by the usa Authorities and in variety of because of the You.S. Department off Farming to assist outlying and you will residential district elements repopulate or retain their populations.

The brand new USDA Outlying Creativity (USDA RD) was a government business serious about permitting outlying groups flourish. Such as for example, Rural Tools Solution (RUS) provides and retains rural system, which is essential for those individuals given to get assets or choosing professions during the outlying portion rather than the town. That have USDA homes finance, rural parts are offered the opportunity to boost their hobby profile and meet up with urban towns and cities.

USDA lenders are formulated getting lower to help you center-earnings home looking to buy property inside parts seemed on the the USDA eligibility map. Needed no down-payment and you may have fixed rates to greatly help possible homebuyers come to homeowners.

With the aid of People Home mortgage officials , you can purchase a home loan to invest in the majority of your home and savor homeownership into the Fl to your really positive terminology.

Benefits of good USDA Housing Loan in the Florida

Considering how expensive housing is across the United States, USDA household members homes programs try a gateway to help you inexpensive monthly costs .

Growers, in particular, produces probably the most regarding the outlying housing services as they can obtain property near its occupation possessions and you can boost their traditions standards. Retired people and people working from home may also make the most of a beneficial USDA loan and luxuriate in life style close to nature but merely a good quick drive off to go to more substantial area.

If you find yourself bustling places tend to hook man’s focus, of a lot designated outlying section are located close to Fl urban centers. You can get a property in a semi-rural RD area and be inside operating distance away from food and enjoyment.

Low interest rates

USDA loans try covered by the You.S. Government – particularly by the U.S. Service away from Farming. Consequently, they arrive which have straight down rates of interest. Since interest levels boost the full amount of cash you have to pay for the mortgage, straight down cost indicate more funds kept on your wallet.

In addition to, USDA rates are fixed. This will help to people budget the monthly expenses during the a foreseeable method. There are no treat rate develops.

Sensible to have lower-income and incredibly-low-earnings property

Geared to mediocre and lower-money earners , Single-Friends Property Secured Fund provide an easily affordable way to safer homeownership, especially in the modern possessions field increase.

The RD offers a selection for most-low-money family, toward Single Friends Homes Direct Home loans otherwise Section 502 Lead Financing Program, as it is known. This choice provides people that have commission help help them boost its cost ability and relieve its payment per month for some time. Multifamily Houses apps and fund can also be found.

Zero advance payment

In place of old-fashioned construction financing, which in turn consult a down-payment anywhere between ten% in order to 20%, the USDA mortgage program means none . That is a benefit for possible residents struggling to save up a tremendous amount. Zero downpayment function more economic room and make home improvements and you may any renovations that might be one of many key goals to make a house out-of a home.

Closing costs are included in the mortgage

Will, settlement costs is collect up to 6% of one’s residence’s worthy of. With USDA RD lenders, these could getting rolled toward home loan. Of many individuals not be able to save sufficient money into the closing will set you back, so a good USDA mortgage provides them with quicker monetary worry.