Zero earliest-date homebuyer guide will be complete in the place of exploring the positives one incorporate buying for the first time (or at least the 1st time over the last number of years). As you figure out how to get your very first domestic, money is a large little bit of the brand new secret. These types of apps and you may rewards helps you get this major buy cheaper:

- Down payment guidance software: Due to the fact a first-day homebuyer, you have access to many options to help using this type of swelling-share cost. Such as for example, of several states render forgivable money you could pertain towards the their down payment, when you’re says, nonprofits and loan providers provide downpayment guidance gives.

- Fannie’s Mae’s mortgage programs: Congress centered Fannie mae inside the 1938. Today, the company offers mortgage apps to simply help the latest and you may repeat homeowners. That includes HomeReady fund. Whilst not arranged specifically for basic-go out consumers, HomeReady can be helpful for finding in the basic family given that it will take merely step 3% down. Also, Fannie mae even offers money that enable very first-go out customers to invest in 97% of residence’s value, which means you just need an advance payment from step 3%. If you find yourself HomeReady is sold with income qualification requirements, the brand new 97% money option doesn’t.

- Freddie Mac computer financing software: Established several ages just after Federal national mortgage association, Freddie Mac now offers likewise advantageous mortgage applications. HomeOne, such as, gives basic-time homebuyers a solution to place just step three% off. Low-money individuals also can talk about the Household Possible system, which provides a unique step three% advance payment choice.

- Preferential therapy of IRA withdrawals. Generally speaking, draw from the private old age account (IRA) before decades 60 has a ten% penalty. But when you utilize the currency to acquire, build otherwise rebuild a first family, you could take-out to $10,000 punishment-100 % free.

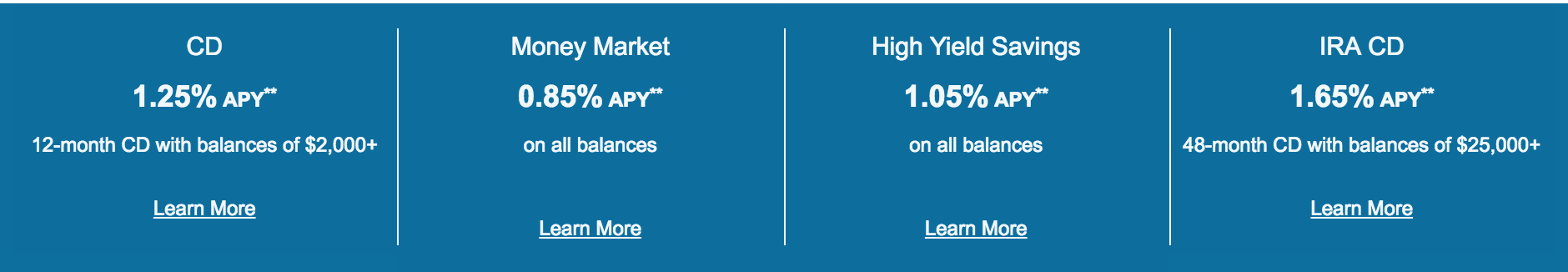

- Lender-considering benefits. Specific lenders promote special software to have basic-go out homeowners, that can come which have pros eg a slightly straight down interest rate or a lot fewer closing costs.

- Support out of nonprofits. Lower-earnings homeowners can be talk about handling organizations like Habitat to possess Humankind, the area Advice Organization Out-of The usa (NACA) therefore the National Homebuyers Loans (NHF). These types of nonprofits all the has software built to help people enter into home for the first time.

- State-particular software. HUD keeps a full page you to definitely links to various nation’s homebuyer support applications. Hitting your state takes one to the appropriate state HUD web site to speak about what exactly is available according to the place you need it.

Become told that many this type of software incorporate income limits. Be sure to qualify for people option you’re thinking about before you can dive from inside the into the needed files.

Out-of deposit assistance software with the option to pull off retirement deals, numerous help can be found to make homeownership attainable so you can the fresh people.

But cash is one bit of new mystery. To learn how to get your first home, help all of our first-time homebuyer guide make suggestions simple tips to go from where you are now in the the new put.

Step 1: Determine whether You might be Ready

To get a property is actually a major financial commitment. To see production into currency you spend in the types of a down-payment and you will settlement costs, it is recommended residing in our home for around 5 years.

Put another way, you will be prepared to buy if you have a relatively solid typical-title attitude. If you were to think steady in your community, you have people loans under control and you also dont anticipate any location transform coming the right path, it could be a lot of fun https://www.availableloan.net/installment-loans-ia/delta/ to find.

Step 2: Wonder: Simply how much Financial Should i Afford?

Choosing you happen to be prepared to get is something. Determining if you can manage to buy is an additional – specifically to the large home prices and home loan rates we’ve been watching lately.