Gateway Home loan is a keen Oklahoma-situated bank that’s a subsidiary off Gateway Basic lender. The firm offers different financial affairs, plus fixed-rate mortgage loans, adjustable-rate mortgage loans, FHA fund, Va loans and USDA finance. The firm and works in most of the U.S.

Portal is known certainly Financial Government Magazine’s Most useful 100 Home loan Companies regarding the U.S. on a yearly basis ranging from 2012 and you may 2019. From 2013 loans New London so you can 2019, the company together with featured for the Inc. Magazine’s directory of the new 5000 Quickest Broadening Individual Enterprises.

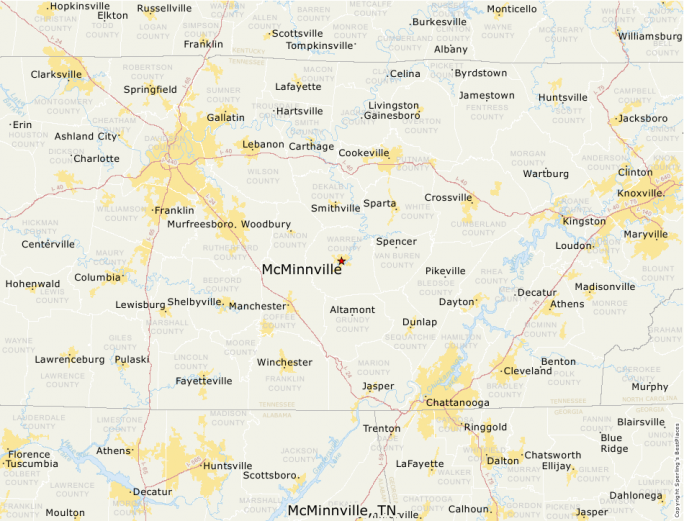

Gateway Mortgage originates financing throughout the following the 39 claims and you may Washington, D.C.: Alabama, Arizona, Arkansas, Ca, Colorado, Connecticut, Delaware, Fl, Idaho, Illinois, Indiana, Iowa, Ohio, Kentucky, Louisiana, Maryland, Michigan, Minnesota, Mississippi, Missouri, Nebraska, Vegas, Nj, New Mexico, North carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Sc, South Dakota, Tennessee, Texas, Utah, Virginia, Arizona, Western Virginia, Wisconsin and you can Wyoming.

What sort of Financial Can i Get Having Gateway Financial?

Fixed-rates mortgage: This is actually the best kind of financial offered. A speed are locked during the at the beginning of the loan and will not transform. Portal even offers them with terms of between 10 and you will 3 decades.

Adjustable-rate home loan (ARM): Which have changeable-speed fund, you will find a fixed rates to possess a-flat period of time, right after which the interest rate are sometimes modified. Portal also offers step 3/six, 5/six, 7/6 and you may 10/6 loans. The initial amount represents the size of the brand new fixed-rate months, and also the half dozen designates that whenever that pricing is actually modified twice a year.

Jumbo finance: These performs a comparable means as the conventional financing, but are having bigger levels of currency. To have 2023, the restrict to own a traditional financing are $726,2 hundred in most of the nation, although it might go around $step one,089,300 in some highest-costs areas of the world.

FHA Funds: FHA fund are available in conjunction with the Government Houses Administration (FHA). They need as little as step three% downpayment and therefore are accessible to consumers having smaller-than-sterling borrowing records.

Virtual assistant loans: Virtual assistant fund appear for the backing of the U.S. Veterans Administration so you can experts of the armed characteristics. There’s absolutely no advance payment needed and rates of interest are generally a lot better than with antique fund, however, there try good Va money commission.

USDA funds: USDA money, developed by the new Service out of Agriculture, require no advance payment and will be got having the lowest credit score. He is only available during the appointed rural areas, even though.

So what can You do Online With Portal Mortgage?

You can sign up for that loan on line having Gateway Home loan, definition you will not have to take the problem of getting toward an office in order to satisfy that have home financing broker. You can explore Gateways website to autopay the loan. This makes it more straightforward to make sure to state up to go out in your payments.

Is it possible you Be eligible for a mortgage of Portal Financial?

Gateway doesn’t promote a specific minimum FICO get for its mortgages. Although not, usually, a credit history with a minimum of 620 needs to have an excellent antique financing, either fixed otherwise changeable. Funds with regulators backing possess a diminished FICO score needs. For example, an FHA loan might only call for at least credit score out-of 580.

To have traditional money, an advance payment of at least 3% is needed, although this could changes on the a customers-to-customers base. If you can gather up no less than 20% down, you may not you would like individual mortgage insurance (PMI), that’s practical along the industry.

What is the Process for finding a mortgage With Gateway Financial?

You can begin the process by getting preapproved for a financial loan using Portal Mortgage’s site. You can easily upload all associated data files and you will Portal will discover that which you qualify for.

After that, you’ll need to get a hold of property. After you have a house we would like to get, you’ll take your pre-recognition making a deal. The mortgage will go to a keen underwriter to own latest acceptance. When your mortgage is approved, you can personal the new deals – including investing relevant settlement costs – and also have their techniques.

Exactly how Portal Home loan Stands up

You can aquire every mortgage possibilities you are searching for at the Gateway Home loan, in addition to well-known government-backed applications. If you live in a condition where Portal operates, you may possibly manage to find what you’re in search of.

Notably, Portal features strong on the internet units, like the ability to apply for financing and work out financial repayments on line. Of a lot shorter lenders cannot promote this, very that’s a primary and additionally into the team.