Possibilities

On the web Loan providers. These businesses have a tendency to render a handy software techniques, small recognition, and you may competitive pricing. You may choose examine prices, terms, and you will charge out-of multiple on the web loan providers for the best choice to suit your economic means.

Personal line of credit away from Ent Credit Commitment. Along with signature loans, Ent Borrowing from the bank Union also provides personal lines of credit. A personal line of credit offers accessibility a predetermined credit restriction that you can acquire regarding as required. You have to pay notice towards the matter make use of, it is therefore a flexible borrowing alternative.

Handmade cards. Credit cards are used for small-name money means. They supply an effective revolving personal line of credit that can be used having instructions and you will balance transfers. Depending on your credit history, it’s also possible to be eligible for playing cards with 0% introductory s. not, be mindful of high interest rates for individuals who bring a balance.

Financial loan. Local finance companies and you will borrowing from the bank unions close by, including Friend, KeyBank, otherwise FirstBank, may promote personal loans which have competitive terms and conditions. Checking out a city branch offer personalized recommendations and a go to discuss your debts.

Fellow-to-Fellow (P2P) Financing. P2P financing platforms like Prosper and you may LendingClub hook individuals having private buyers happy to money finance. These types of systems may offer aggressive pricing, as well as the application processes is generally on the web.

Domestic Equity Funds or Credit lines. For people who own a home, you might thought property equity financing installment loan Idaho or home guarantee line off borrowing from the bank (HELOC). These fund use your residence’s collateral while the security, will causing lower interest levels compared to unsecured signature loans.

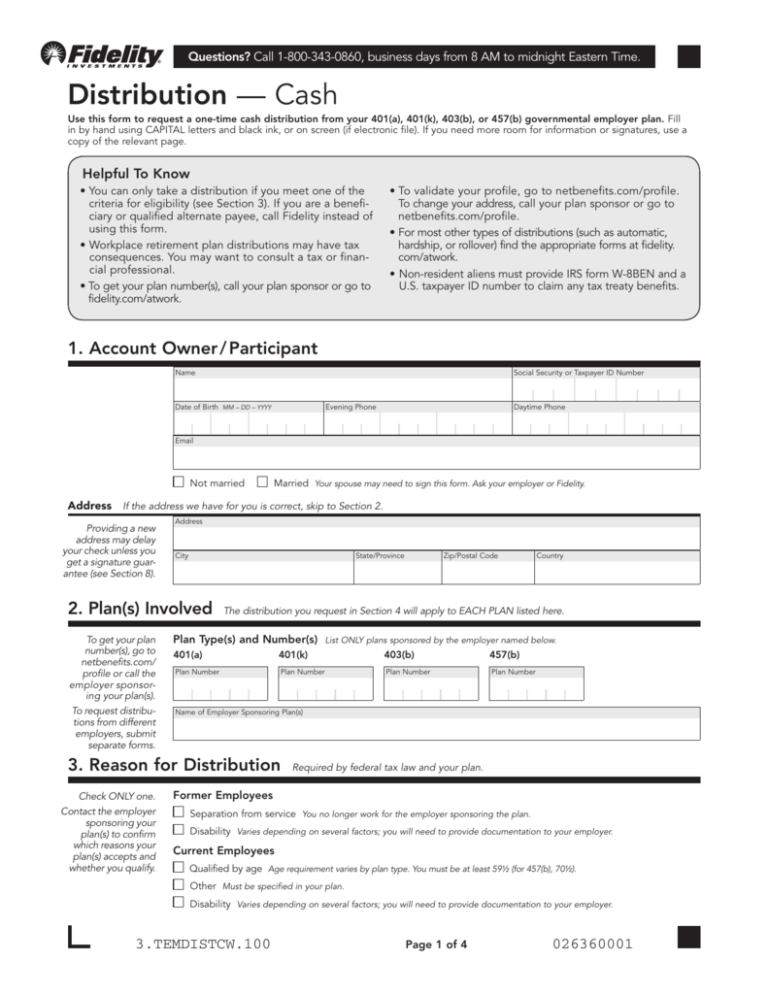

401(k) Money. When you have a 401(k) retirement account, you happen to be able to borrow on it. That one will likely be put carefully, that you can impact their enough time-term advancing years deals if not paid because the concurred.

Article Advice

Ent Borrowing Union’s personal loan products provides consistently displayed a partnership so you can getting obtainable and versatile monetary approaches to the people. Having competitive interest rates, transparent terms, and you may numerous fees choices, Ent’s signature loans is going to be an important device for folks looking to to deal with the varied financial demands. The financing union’s emphasis on knowledge per borrower’s unique items and you can giving customized financing conditions establishes they aside in the financing landscape. Furthermore, Ent’s reputation for customer service as well as desire to work alongside borrowers facing pressures reveal their commitment to economic really-being. While deciding any mortgage is a huge decision, Ent’s method of personal credit aligns with in charge borrowing techniques, therefore it is a significant option for the individuals trying to a professional and you will member-dependent financial partner. Just like any economic choice, prospective borrowers should meticulously check their requirements, compare terms, and ensure that a consumer loan aligns making use of their a lot of time-label economic desires.

Important

Looking after your Obligations-to-Earnings (DTI) ratio less than 31-40% of your month-to-month income is extremely important. This will help you avoid potential economic difficulties later on. Additionally, always assess the prerequisite and you can feasibility regarding delivering a loan, making sure you can conveniently manage its cost.

Strategy

In the Finanso, we carried out a comprehensive analysis of over 100 lenders, assessing them according to 35 more details across the half dozen key categories: usage of out-of finance, consumer relationships, quality of service, rates of interest, and openness from criteria.

Inside the each class, we carefully thought many crucial products in selecting a lender. This type of facts include the interest rates, readily available loan wide variety, minimal credit history, lowest income, application charge, and also the price from which money are directed.

Within Finanso, we very worth our very own users, that is why i in addition to concentrate on the quality of customer provider, reading user reviews, and extra provides that will assistance our profiles for making an effective well-told choice.