Simply how much financial must i log in to my salary? When you are an effective salaried personnel therefore want to individual property, this is actually the very first concern one to comes up in your mind. This short article demonstrate just what section of your income is recognized as if you’re calculating eligibility, which are the common income pieces & their eligibility amounts, do you know the other variables inside your qualifications ultimately exactly how simple it is to apply for a home loan.

To order an individual’s home was a major step for most people from inside the reaching a sense of settledness. That is specifically a condition part of Indian community. Although not, for almost all the brand new salaried people, real estate costs are beyond its arrive at. Just shortly after faithfully strengthening its offers can they finally make this fantasy a real possibility, tend to later on in life. That is where availing of a mortgage can also be catapult yourself to attain their homeownership fantasy while very young.

Know your own paycheck:

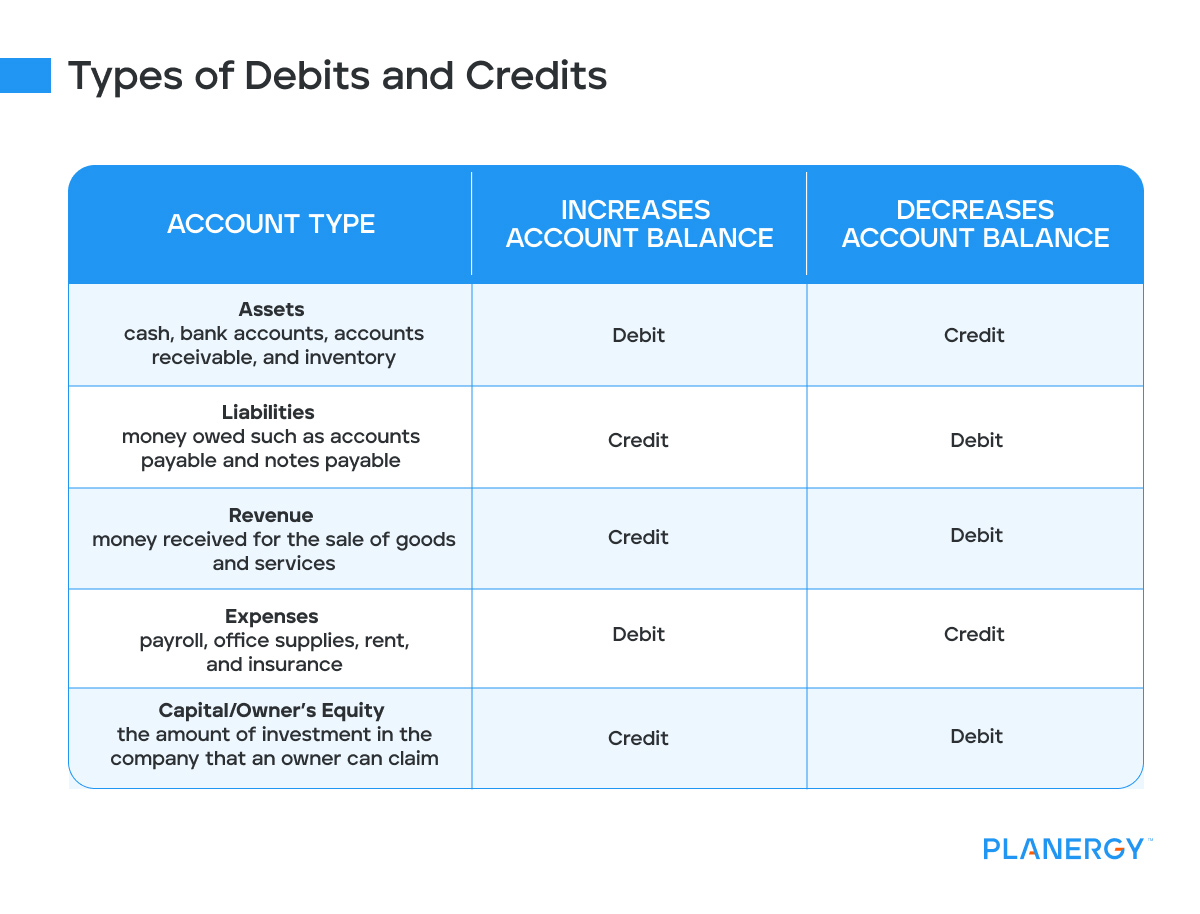

Estimating salaries can also be cover playing with data symbolizing sometimes disgusting or online (in-hand) income. For this reason, it’s important to comprehend the difference in disgusting and you will web income. It is because financial institutes often consider the internet element of an individual’s income when you’re going to their property financing eligibility. Salary build differs around the various teams. However, its generally divided in to the second section:

- Basic Salary

- Allowances Such as for instance Scientific Allotment, Exit Take a trip Allotment (LTA), House Rent Allotment (HRA), Most other Allowances, etcetera.

The above elements form the new gross area of the paycheck. not, this is simply not the last amount the employee takes domestic. There are some necessary write-offs in the terrible full. Speaking of deductions on the Worker Provident Loans (EPF), Income tax Deduction within Source (TDS), Elite group Tax, etcetera. The latest write-offs done, the rest count constitutes the web based paycheck, and therefore personnel is name the when you look at the-hand pay otherwise salary. Financial qualifications calculation considers an enthusiastic applicant’s websites salary close to almost every other activities.

Exactly how much Mortgage Do i need to Log in to My personal Paycheck?

Generally away from thumb, salaried people are eligible to go back home money everything to 60 moments the net monthly earnings. Very, if your web month-to-month salary is actually ?forty,000, you can buy a mortgage around just as much as ?24 lakh. On top of that, for folks who secure ?35,000 30 days, you can buy just as much as around ?21 lakh. A precise way of coming to qualifications has been a great mortgage qualification calculator that takes into consideration different products other than net monthly income. For a quick reference, i’ve noted off common online month-to-month earnings pieces in addition to their related count qualification. This type of thinking was indeed determined utilizing the HomeFirst Home loan Eligibility calculator and if another requirements:

Note: If there’s more step one making user inside a household, the web monthly earnings of all of the making players are going to be joint to arrive at a higher mortgage eligibility number.

Additional factors Impacting Financial Qualifications:

- Age: Home loans are available for candidates ranging from 21 in order to 55 ages old, however, basically, monetary schools love to approve mortgage brokers toward younger populace. The reason is that more youthful people has a longer doing work lifetime. Therefore, the likelihood of payment out of mortgage brokers is highest. About 50s, that ount as well as a smaller cycle.

- Employer and you will Performs Sense: People involved in a respected company will get home financing because they are considered better. Thus giving rely on out of prompt percentage regarding EMIs. At exactly the same time, if you’re employed in a respected organization, then you may be eligible when deciding to take a high count opposed so you can individuals dealing with not so reputed business in the event the all other affairs are thought equal. Furthermore, your projects experience talks a great deal about your stability and you will acts given that a positive tip on your own app.

- Credit score: One of the very important facts inside the choosing their qualification can be your past fee track record of money coincidentally captured by credit score . Even although you earn an incredibly handsome paycheck, a dismal credit rating is adversely effect your odds of getting a home loan. Basically, monetary education prefer a credit rating of more than 650. A credit score significantly more than 750 also can give you an upper hands so you’re able to price to own lower home loan rates.

- Existing Debt (also known as Repaired Duty so you’re able to Money Proportion otherwise FOIR): Monetary schools arrived at mortgage count eligibility out of men personal loans in Colorado for bad credit simply shortly after looking at its established loans about the EMIs and you will a good expenses regarding most other money that they have availed including a car loan, individual tough mortgage, personal loan, handmade cards, etcetera. Lenders focus on in charge financing strategies, that’s the reason it assess net income to make sure in check costs and you can EMI to own mortgage consumers. FOIR is the part of the sum of the All of the Existing Monthly Debt in order to a person’s internet month-to-month earnings. Normally, it ought to be less than 50% to have qualification.

- LTV (Mortgage to help you Value): Even though you features a high home loan qualification with regards to of the websites month-to-month income, financial education only funds around 75% so you can 90% of your total cost of the house. This is accomplished to be certain he has sufficient boundary in order to liquidate the underlying advantage & get well the matter in case of a standard.

- Property’s Court & Tech Acceptance: With regards to lenders, wellness of root investment are most important. Economic Institutes possess 2 chief comparison standards on the assets you to this new candidate is about to purchase. The original a person is to examine brand new legal strings of your own assets to ascertain a very clear label & ownership while the next you’re to determine the market price of the property. These two ratings are often done-by separate solicitors & valuers who’re appointed because of the one to monetary institute.

Submit an application for Home loan:

In advance of initiating a search for the fresh new dream house, you’ll have some suggestion concerning the mortgage amount your will be qualified to receive according to the income. This will help to to make a financial decision about the possessions you need to pick. You can examine the home mortgage qualifications calculator so you can estimate how far matter youre entitled to rating. Due to the fact property is finalized, you can visit the HomeFirst site and you will fill-up the new query form to receive a call back from our Counsellors. You could recommend this post knowing more info on mortgage terms and conditions or this short article to possess documents you’ll need for financial programs

Into the a lot more than suggestions positioned, one can answer fully the question out-of simply how much house loan that can get on their/their unique income. It will help them bring a big step for the to order its dream household.