The brand new lawyer fees have been dishonestly extra by lender so you can Contours 1102 otherwise 1103 which have been lines on the HUD function created specifically towards the revealing out-of other fees otherwise costs, not to loans Carolina have lawyer costs

For many years, Defendant loan providers fooled Relators. Accused lenders stated that attorney charges and other unallowable charges was basically allowable charge, even if the step 1% origination payment try surpassed. Which was not true.

Rather than using the lines to your HUD setting to have identity test and you will name browse to accurately declaration the real cost of name really works, Defendant loan providers were and therefore are plus undisclosed attorneys costs and you will almost every other unallowable fees on the amounts they show to have term test or label research. This means that, Accused loan providers are fraudulently revealing costs and costs over exactly what will be noted on Contours 1102 and you may 1103. As a result, you to definitely loan providers statement, towards Lines 1102 and 1103 of one’s HUD versions, charges supposedly sustained for name test and you may term search charges during the quantity between $525 to $1200, when in reality the price of name examination and you will title search charge is to amount to only $125 to help you $two hundred. By you to definitely deception, lenders has actually defectively lumped unallowable costs having deductible will set you back. Brand new created result is your seasoned/borrower try recharged too-much and you will illegal charges from the closing.

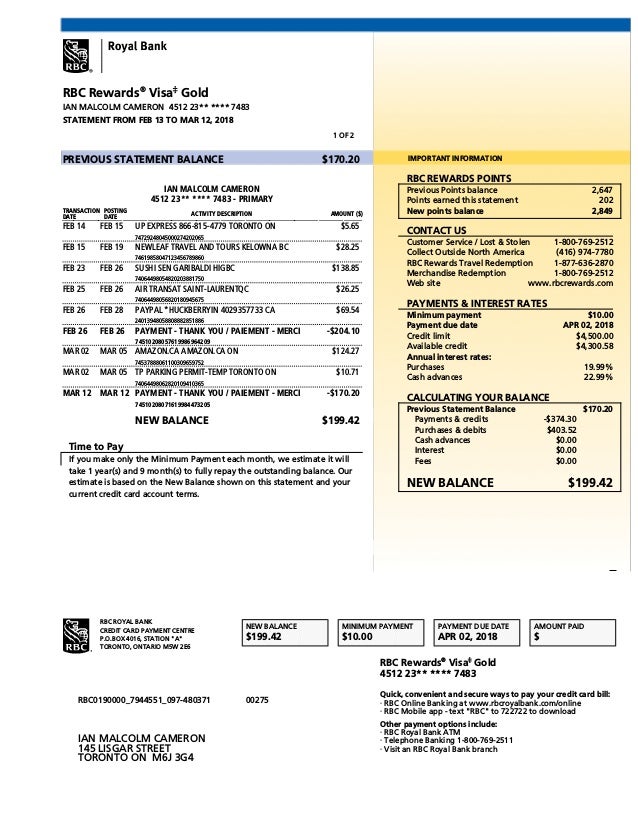

Display A signifies that Offender Wells Fargo didn’t securely statement extent covered attorney fees to your HUD setting. Range 1107 must have become familiar with report the actual lawyer fees, however, Offender Wells Fargo doesn’t statement attorneys costs on the internet 1107. As an alternative, Offender Wells Fargo poorly included the newest attorneys charge towards the term test percentage. The brand new Accused financial said $950 with the title examination payment on the internet 1103, but a good and you will custoination is on list of $125$two hundred. Regardless of if Display A says simply a good example for Defendant Wells Fargo, equivalent advice exist for each and every of your other Offender loan providers.

Even though brokers, such as Relators, do not sit in the new closings otherwise get ready HUD forms, the lending company delivers new agents a copy of one’s HUD function following the loan shuts. Of the exploring the HUD means after the closure, Relators often see the lenders was basically concealing illegal costs to help you new experienced.

Relators plus unearthed that Offender lenders’ illegal throwing out of unallowable fees wasn’t limited by Lines 1102 and you may 1103 of the HUD form. Lenders in addition to undetectable unallowable costs towards the traces of HUD function meant for most other allowable charge as well as have also bundled otherwise exorbitant deductible costs more than what is actually practical and you will customary in the contravention from Va guidelines.

The most common unallowable costs which was included inside the having costs on the web 1102 or 1103 is lawyer charges. People lawyer costs reduced should have already been listed on Line 1107 of your HUD variations. The vast majority of the new IRRRL fund and this contained unallowable costs only leftover Line 1107 empty and thus representing on the Va and to brand new seasoned one zero attorneys costs was indeed sustained otherwise charged. Which was not true. One deceptive practice was a bogus Claims Operate violation.

In their analysis, Relators reviewed numerous specific HUD variations prepared by Offender lenders’ closing agencies and discovered HUD variations where lender’s lawyer fees was basically undetectable and never disclosed online 1107 otherwise elsewhere with the HUD function

Lenders hid those attorney charge with the addition of extent to own attorney costs to other lines to your HUD means, which were meant to disclose most other fees or charge which were judge and you may deductible. Relators enjoys known such fake purchases committed because of the all the Offender lenders.